When Does a Car Become Eligible for Classic Cover

How Insurers Decide If a Car Qualifies for Classic Car Insurance

At Grove and Dean, we often speak to motorists who believe their vehicle should be recognised as a classic. And in many cases, from an enthusiast’s point of view, that feeling makes perfect sense.

However, classic car insurance is not based purely on how a car looks, how old it is, or how much its owner values it. Insurers assess eligibility using a combination of criteria, including how the vehicle is stored, how frequently it is driven, and whether it is treated as a preserved enthusiast vehicle rather than everyday transport.

A car may be cherished, unusual, or full of character, but it may still fall outside the scope of a traditional classic policy if it remains part of regular daily use.

So instead of asking:

“Is my car a classic?”

The more relevant question is:

“Would an insurer consider my car appropriate for a classic car insurance policy?”

That distinction is important for anyone hoping to access the specialist benefits and cover options that classic insurance can provide.

Is Your Car Old Enough to Be Considered for Classic Cover?

Many vehicles reach fifteen or twenty years of age, which is often used as a starting benchmark by insurers. This broadly aligns with HMRC’s own classic age guidance.

But age alone is rarely enough to qualify.

Insurers also want to see that the vehicle has moved beyond being a standard older car and has entered a stage where it is collectible, enthusiast-owned, or maintained as something special.

Plenty of vehicles may be ageing, but are still used routinely, continuing to depreciate, and not yet regarded as having classic or historic appeal in insurance terms. A car might feel “classic” to its owner, but if it’s still being used for everyday commuting, insurers may take a different view.

Which leads to the biggest deciding factor of all.

Does the Way You Use the Vehicle Affect Eligibility?

Yes, definitely. How the car is used is central to classic insurance acceptance.

Classic policies are generally intended for lower-risk vehicles that are driven occasionally and carefully, rather than relied upon for daily transport. Insurers typically expect classic vehicles to be:

used mainly for leisure driving

stored securely when not in use

well cared for by an enthusiast owner

taken to shows, events, or club activities

They are not usually designed for high annual mileage, heavy traffic commuting, or constant year-round use.

Once a vehicle becomes something enjoyed rather than depended upon, the overall risk reduces. That lower risk is one of the reasons classic policies can offer specialist benefits and often competitive premiums.

At Grove and Dean, we recognise that not every enthusiast uses their car in the same way. Some owners want to drive their classic more regularly, and even if a vehicle doesn’t fit within a strict traditional scheme, specialist options may still be available depending on usage.

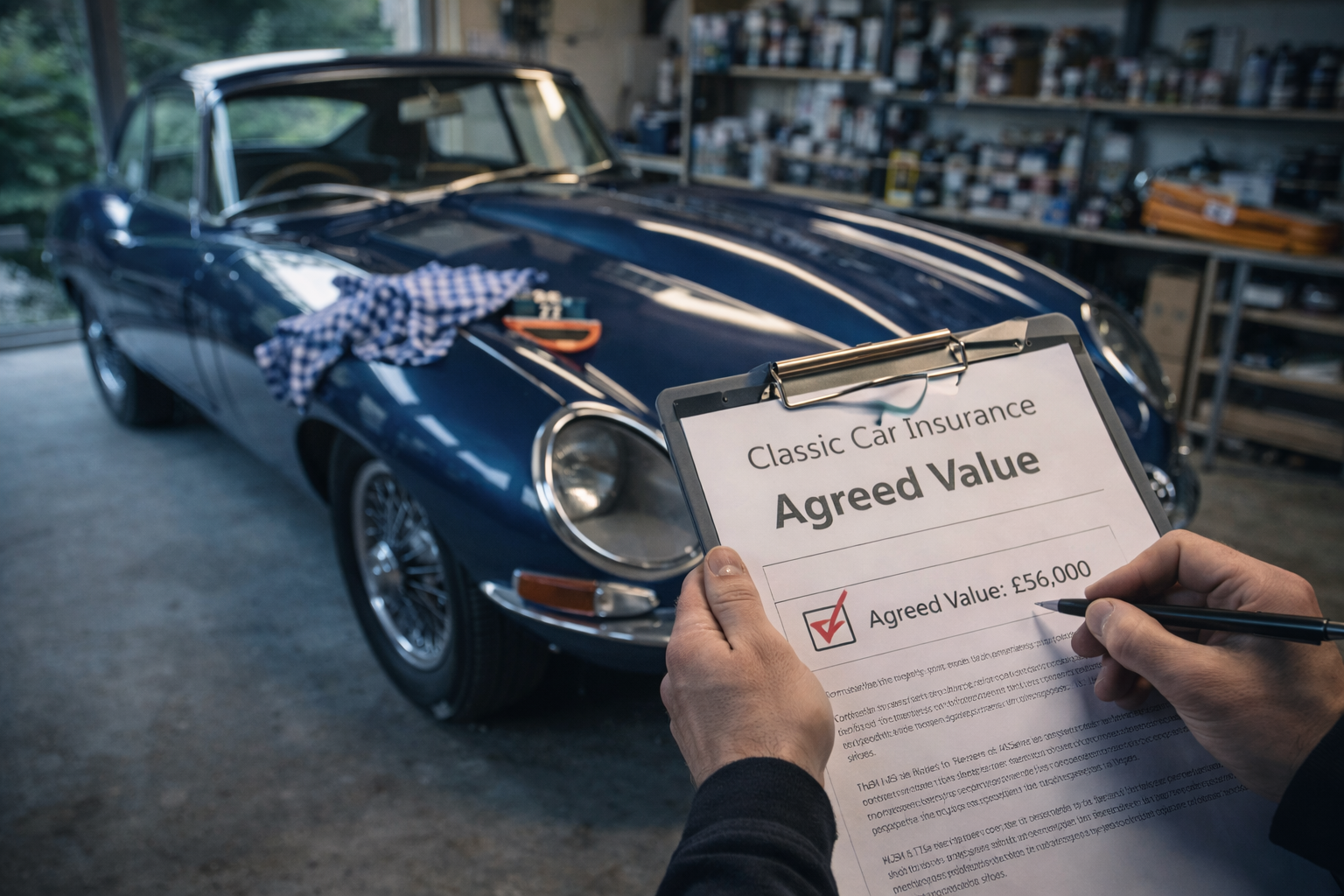

Why Do Insurers Offer Agreed Value Cover?

One of the key advantages of classic car insurance is agreed value, but this feature is generally reserved for cars that meet classic eligibility standards.

With standard motor insurance, payouts are usually based on the market value of the car at the time of the claim. For classic vehicles, that approach can be unreliable, as values are often shaped by collector demand, rarity, and restoration quality.

Without agreed value, an owner could lose their vehicle and receive a settlement that does not reflect what it is truly worth — or the investment made in maintaining it.

Agreed value eliminates this uncertainty. The insurer and policyholder agree a set figure in advance, supported by photographs, records, club valuations, and evidence of similar sales. That agreed amount then becomes the guaranteed payout if the vehicle is stolen or written off.

Newer vehicles are far less likely to qualify for agreed value because their prices continue to follow normal depreciation patterns.

Does the Driver Matter as Much as the Car?

Absolutely. Classic insurance eligibility is not only about the vehicle — insurers also consider the driver.

Classic policyholders tend to represent a lower-risk group, and insurers often look favourably on drivers who:

keep mileage limited

store the car securely

have another vehicle for everyday use

treat the classic as a hobby rather than transport

Claims experience across the industry shows that classic owners generally have fewer incidents, which allows insurers to offer specialist policy features such as laid-up cover, limited-mileage discounts, and enhanced protection for rare parts.

Premiums can often compare favourably with standard cover, though this will always vary depending on the car, driver profile, and intended usage.

What Other Factors Can Improve Classic Eligibility?

Alongside age and mileage, insurers may also consider wider indicators that a vehicle has entered the classic category, such as:

involvement in enthusiast communities or clubs

restoration work or strong originality

limited production numbers or rarity

increasing collector interest

stable or rising market values

The classic vehicle market continues to shift over time. Recent reports have suggested a slight softening in global collector prices as higher interest rates reduced speculative buying.

Even so, top models still perform strongly. Cars such as the 1971 Lamborghini Miura SV have reportedly risen by more than 30 percent over the past year, demonstrating that scarcity and history remain powerful drivers of value.

For insurers, these trends underline an important point: classic policies are built for cars that are preserved and cared for, not simply getting older.

So, Would Your Vehicle Qualify for Classic Insurance?

Classic cars remain hugely popular throughout the UK, but insurers do not define them purely by age.

Eligibility is usually shaped by a combination of usage, care, rarity, and ownership purpose. A car becomes suitable for classic cover when it is maintained as something special rather than simply used as everyday transport.

Once an insurer recognises that difference, specialist features such as agreed value and tailored protection often follow.

Many vehicles will reach “classic age” over time — but they typically need to move beyond daily working life before they qualify for a traditional classic insurance policy.

And If You Drive Your Classic More Often…

At Grove and Dean, we understand that classic cars are not always reserved for sunny weekends. Many enthusiasts enjoy driving their vehicles more regularly.

If your car doesn’t meet the criteria of a standard classic policy due to its usage, there may still be specialist cover options available depending on your circumstances.

Get a quote online today and we’ll help you find the most suitable cover for both your car and how you use it.